12 Reasons Why Evernote is THE Choice for Tax Management and Financial Organization for the Self-Employed

I love being self-employed. And, like you, I hate paying taxes. To be fair, I also hated paying taxes when I was an employee. But, converting to a business owner brought a new level of stress, fear, and chaos related to taxes that I hadn’t fully appreciated in advance. Not only did I suddenly have an acute desire to track every possible expense I qualified for in my new “self-employed” status, but I also quickly learned that all the things that lead up to tax filing take on new meaning as a business owner. In short, "taxes for the self-employed" is so much more than taxes. It is about the organization and management of:

Receipts

Expenses

Bookkeeping

Financial reports

Tax filing

Bill paying

Debt management

This realization overwhelmed me. I realized that all these areas are related, and they all impact the success or failure of my business. I quickly identified that I needed to create a system to manage all of these categories if I was going to ease the stress the concept of “taxes” triggered in me.

Over the years, I have done just that. I've created and refined a comprehensive financial management system. The reoccurring trauma over taxes and financial management I felt when I started my business is now nonexistent. My only discomfort with taxes now is that I still have to pay them. My entrepreneurial energy is no longer spent with worry over taxes, or audits, or invoicing, or reconciliations. My energy is spent focused on higher level business thought and work that moves me closer to my business and life goals. It has been transformational. I finally feel like a real business owner. And, I have the assurance to confidently move forward on a daily basis.

The lynchpin of my financial management system is Evernote.

Evernote enables me to:

Have perfect expense tracking

Keep zero paper receipt storage and find any receipt for any tax year from any device anytime I should need to (an auditor would be impressed!)

Easily create error-free bookkeeping transactions from revenue and expenses. I’m now an informed entrepreneur who can run an accurate balance sheet, income statement, or business financial report any time I want to.

Make on-time payment of bills, quarterly taxes, and annual taxes. No more extensions needed!

Scale. I can extract myself from the process and hire support in my bookkeeping and tax prep without changing my system.

Reduce the effort and energy I was spending on all this. My Evernote-centric system is simple to manage and maintain.

In addition to Evernote, other softwares are used in my system (for example, Xero for my accounting tracking). But, these choices have more flexibility (I could substitute Xero for Quick Books Online or Excel, for example). Evernote however cannot be substituted. It is the command center that empowers my entire process and is also my financial document repository.

Explaining why Evernote is critical to my system often proves challenging. I often hear: “I keep my receipts in Dropbox (or Google Drive, or OneDrive, or <whatever>)", why do I need Evernote?” or “I’ve keep paper records for years…why is Evernote better?” If you have this question, read on.

This post provides a comparative context to explain why Evernote is the cornerstone of my financial management system, vs other commonly adopted options. This table provides my perspective on a feature comparison between common options and I explain more about each feature as it relates to Evernote below:

1: Online Access

Online access to your information is really about two things:

If you are going digital with your tax management process (vs. paper based) and

If you are going cloud based with the storage and management of your tax process (vs on your local hard drive)

To be contemporary and not antiquated in your financial management process, you are going to choose a system that is both digital and cloud based. This is going to rule out paper based and local hard drive based systems that many still use. Choosing a system that is digital and cloud based will require a choice about where you are going to store your digital receipts and documents. The choice I advocate is Evernote, a cloud based application. Other options, including Dropbox, Google Drive, One Drive, and iCloud, replicate the file structure you had on your local hard drive and put them in the cloud to give you the benefits of online access (#1), mobile access (#2), and redundancy (#3). This is a big step forward from local hard drive and paper based systems, but it does not go far enough. Evernote provides cloud based storage of files, but also with flexility in organization and display that is not available in cloud based drive solutions. It is far more powerful. Read more on this advantage in the sections below.

2: Multi-Device & Mobile Access

Another perk of cloud based technology is the access you can gain to it from nearly any device - your computer, mobile phone, tablet. Cloud based options offer multi-device access and have local applications developed for the major operating systems. Evernote, for example, has device specific applications that maximize the speed and user interaction through apps built specifically for Mac, Windows, iOS, and Android. These apps make access to Evernote easy and enjoyable from whatever device you are on. Compare this to the choice of storing your documents on your hard drive where the only access option is from that exact machine. This is very limiting in an increasing mobile world.

3: Redundancy

The other disadvantage to keeping data on your local hard drive or in a paper format is the lack of redundancy. If you have a fire in your home where your paper receipts live, or your computer gets damaged or stolen, your information is gone. This is problematic.

When you choose a cloud based technology for your financial management system, you have redundancy. The cloud service you choose provides redundancy in the back-up of their own servers, plus, as in the case of Evernote, a local copy of your data lives on your computer and syncs to the cloud via the device specific app they create (see #2).

The benefit of this is illustrated from this personal example I admit to. One sad morning, I spilled iced tea all over my beloved MacBook Air keyboard. By lunch time, I was the begrudgingly proud owner of a brand new MacBook Air. Within the time it took to download the local Evernote for Mac app and sync my cloud based Evernote account to my new machine (I have a big account….it took about 10 minutes), I was back up and running at the same level of productivity and file access that I had before I poured myself the iced tea that morning. My computer (and phone) is simply a window to my data. It is not the primary or sole storage of my data.

4: Offline Access

Wifi connections seem nearly ubiquitous these days, but they can’t always be guaranteed or relied upon. So, when you make the move to cloud based technologies, the next thing to consider is if you have offline access to your data. Most cloud based storage technologies have an offline option. For example, Evernote, Dropbox, Google Drive and iCould Drive all offer a sync of your cloud data to your local desktop which enables data to be accessed on your local machine, even if you aren’t connected to the cloud. Note that local access can be a paid feature. This is the case in Evernote, where all users have cloud based access to their data, but you must be a paid subscriber (either plus or premium level) to gain offline access to your data.

5: Storage of Digital Documents

There are plenty of choices for storing digital documents (.pdf’s, .doc’s, .xlc’s, .pages, .png, .jpg, etc). All the digital tools presented provide a functional solution for this. Also note that both Evernote and any of the cloud storage services are comparable in that they will all allow you to store any file format that you can create: a PDF statement that you receive from your bank, a jpg image of a receipt that you photograph from your phone, or a scanned image of an invoice that you received in the mail. These can all be stored on cloud storage applications, but, continue on to understand why Evernote my choice for storage of my receipts, statements, and other financial documentation.

One difference comes in how the services charge. Typically, cloud storage services will charge for overall quantity of data stored on their servers (megabytes, gigabytes, or terabytes). In contrast, Evernote does not cap the amount of data you can store in Evernote, instead, they cap the amount of data you can upload on a monthly basis. That data upload cap resets at the beginning of the next billing cycle, and you can upgrade your level of service to Premium if you want to experience a virtually unlimited amount of monthly upload space (they officially cap it at 10GB/month at the premium tier but I have yet to have a single client, nor myself - a serious power user - ever come close to that amount).

This difference alone may not make the case for you to choose Evernote to store documents related to your financial management. However, the remaining features are what convinced me to build my financial management system with Evernote at the center.

6: Storage of Emails

This is one area where Evernote really differentiates itself from the other cloud storage solutions, particularly as it relates to a financial management system. With Evernote, you can forward an email that you receive to a unique email address that comes with your Evernote account, and have that email automatically stored in Evernote as a note. This is a paid feature that is available to users at the Basic, Premium and Business Evernote tiers.

This feature in relation to my financial management system is huge. Think about how many of your financial documents (receipts, bills, and tax documents) come in to you via email. It is a massive amount. When you have a paid Evernote account, you can simply forward that email to Evernote, and it is centralized and retained in your account right along side the digital documents that you are storing in Evernote (discussed in #5). To accomplish the same thing in Dropbox or Google Drive, you would need to print a PDF of your email and save or move the PDF to the proper place on your cloud storage tool. Which would you rather do multiple times per day?

7: Storage of Web Pages

This is another area where Evernote differentiates itself. With the Evernote Web Clipper, you can save web pages that you want to retain into Evernote with the click of a button, and store them right along side the digital documents and emails that you forward to Evernote as described in #5 and #6.

Think of how many times you open a PDF or statement in your web browser. I do it a lot. For example, I get a monthly email reminder from WeWork (my office space), letting me know that I have a statement ready to be paid. I log into my account and navigate to the PDF of my statement. The Evernote Web Clipper automatically prompts me to “Save PDF to Evernote”. This is far more efficient than having to save the statement to my computer and move it to a cloud storage solution. Evernote makes the centralization of all digital information a snap.

8: User Interface

This is my favorite differentiator between Evernote and cloud based storage tools. When you centralized and store your financial documents in Evernote, you have so much more power in the visual display of information. The three section layout of Evernote’s desktop app affords you to preview, visually scan, and/or read documents while still maintaining access to your document navigation. This saves you both mouse clicks and time. In practice, it saves you lots of clicks, and ultimately, lots of time.

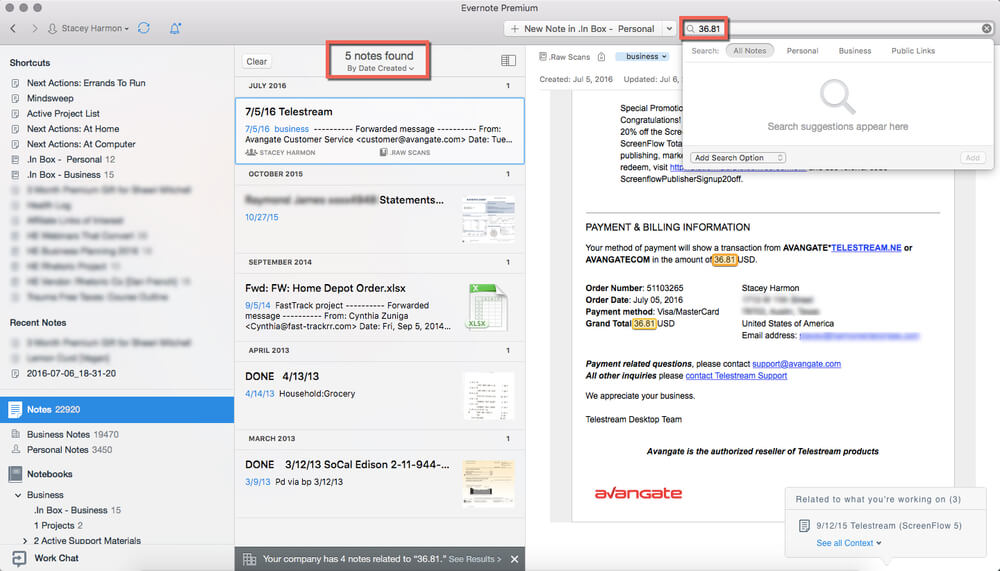

Here is an example. Note in the Evernote screenshot below how much visual information I get in a single screen. I can see my notebook structure on the left, a list of my notes (documents) in the middle, and the detail of my note/document on the right.

Here is the exact same information in Dropbox and iCloud. It takes me 3 screens, and 2 extra clicks to see the same information. And, if I want to switch to the next document, I have to back out (more clicks) to navigate to the next document.

With Evernote however, I can quickly move through the notes in the note list to update the preview in the right hand pane. This yields a much quicker way to interact with your data and find what you are looking for.

This efficiency is gained because Evernote holds documents differently than cloud storage services do. In Dropbox, Google Drive, and the others, the document IS the file. In Evernote, the tax document is part of an Evernote note. In essence, the document file is embedded in an Evernote note.

It may seem a subtle difference, but it means a world of difference in terms of functionality in two key ways.

1: A single Evernote note can contain one document, or multiple documents. It is flexible in this way. (see feature #12 for why this is important in my financial management system)

2: In Evernote, you have the option to view a document as “inline” or “as attachment”. This preference can be granularly set for each and every document that you store in Evernote.

The opportunities these two features provide in my financial management system are illustrated in #12 below.

9: Search

Evernote has always been a leader in offering the most comprehensive search of the cloud storage options. Evernote searches not only the document file name, but also the note title and the content of the note, including:

The text that appears in all .jpg and .png images you store in notes

Handwriting you take a picture of and store in Evernote

The meta-data associated with a note (date created, date updated, location, etc)

The contents of any files stored in a note, e.g. a PDF, a Word Doc, an Excel File, Pages Doc, etc (this is a Premium feature)

And when you combine the power of search with the layout of Evernote which allows for document previewing and multi-note view and navigation (#8), you have an experience not offered by any cloud storage service.

Here is one example of how this is an essential part in my financial management system:

I don’t always recognize the vendor name that my accounting software sucks in from my bank feed (do you?!). I end up asking myself, what did I spend $36.81 on?

If my receipts were in Dropbox, and I did a search for $36.81, I'd get no results because I can only search the name of the file for a match and the amount of the receipt doesn’t appear in the name of the document. The receipt is there, but I would have had to know the name of the vendor in the filename to locate it, but I don’t know that because that is the information I’m seeking:

But, I store my receipts in Evernote (get my free setup guide that includes what notebooks to create to store yours in Evernote too), so I go to Evernote, do a search for the amount ($36.81) to find the receipt. Any note that contains $36.81 come up (in this case 5 were instantly found in my account which holds over 22K notes - no waiting needed). The user interface lets me quickly move between, sort, and preview the 5 documents so I can locate the exact receipt and remember the context of what my charge was about. It takes me just a few seconds.

I'm able to quickly identify the charge in Evernote that my accounting software is trying to reconcile allowing me to accurately reflect the vendor and expense category in my accounting software:

This aides in accurate categorization of expenses yielding better financial reporting, proper deductions, and stronger business intelligence. Of course, in order to succeed in this, you need to centralize your documents in Evernote. I give you the structure to do that in my free Getting Started Guide which you can download here.

10: Share-ability

All of the cloud services offer the ability to share documents and control permissions to documents, Evernote included. And, Evernote makes it easy to share notes and notebooks with both Evernote users (via Work Chat) and non-Evernote users (via email and public-links). And, permissions can be assigned and revoked as needed. One way I benefit from this share-ability is that I use a public link to provide access to my tax documents by my CPA (who does not use Evernote). I simply include a link to the notebook in the email I send him and he has one click access to my completed tax planner and supporting documents (1099’s, 1095’s, etc).

11: Collaboration Experience

Because the basic unit of Evernote is a note, and a document is just one element of a note (see #8 for further clarification), I am able to add context about documents to notes, right next to the document. This feature, combined with the ability to share notebooks with others (#10) enables my team to retain conversation and the logic related to the document right next to the document. For example, my bookkeeper and I can log a conversation about an expense receipt right in Evernote as part of the expense receipt note:

This not only eliminates the need for back and forth emails to answer questions, but also creates a history of the decision that I can reference for years to come - a very handy element should I ever be audited and asked to defend my expense categorization.

12: Merging Notes

One of the great Evernote features that I harness in my financial management system is note merging. Since the basic unit of Evernote is a note (vs a document - remember a document can be added, or embedded, in a note), Evernote allows me to merge, or combine, notes together.

This need to group like documents together often arises in financial record keeping. For example, consider the process of generating an invoice for your services, and receiving a check as payment. This generates three “documents”: 1) the invoice, 2) the check, and 3) the confirmation of that check being deposited to your bank (either via email or a paper deposit receipt). Cloud based storage systems represents each document separately:

Dropbox stores each document as a separate file

In Evernote though, I can take these three individual documents and merge them into one single note (something you can’t do in cloud storage applications such as Dropbox). This provides a full record of the financial event in one document, not three. Not only is this tidier, but if you every are audited, or need to recall the elements of this transaction years later, this consolidation is very helpful.

I can also “collapse” the length of my new merged note by choosing to view the PDF documents “as attachments” vs “in line” which makes working with multiple documents in a single note neater as introduced in #8.

There you have it. These are the features Evernote offers that make Evernote the clear choice to be the backbone of my financial management system. And, I love my system for these reasons:

I can unequivocally defend my numbers in the case of an audit without derailing my world.

It is easy, paperless, and captures 100% of my expenses.

I know when my bills are due and I pay them on time.

I’m a smarter business owner. It improves my decision making and business planning. I can run financial reports anytime and have business intelligence based on my spending patterns and cash flow

I don't have to manage myself. I am able to outsource my bookkeeping and tax preparation without changing or disrupting my system. And, I have management oversight to the process of these outsourced vendors.

I have a sense of peace and control around my finances - both business and personal. And, you hopefully had a bit more insight into why I love Evernote so much. If you are a self-employed person who is willing to 1) learn about Evernote, 2) make some simple behavioral changes, and 3) execute on a few key decisions, I promise, you can experience the same. To help you, I created a quick start guide for the self employed to help you take action on these three items. Download it for free here.